The affordability of health care–or lack thereof–has become an urgent challenge for state policymakers. The cost of care consistently ranks as a top concern for patients, families, and employers. Premiums and deductibles continue to rise, placing pressure on household budgets, while wage growth lags. At the same time, aggressive hospital billing and debt collection practices can expose even insured patients to significant financial risk. State policymakers who want to provide relief to residents and reduce health care costs can consider several types of reforms.

With meaningful federal action unlikely this year, states are positioned to lead on health care affordability. Luckily, state policymakers already have a toolkit at their disposal, and many states have been working to promote affordability for quite some time. Over the years, they have built a roadmap of practical strategies, including price and billing regulation, competition and ownership reforms, and transparency and reporting requirements. These efforts show that state-level interventions can be effective, offering models policymakers can build on to improve health care affordability for consumers.

Price & Billing Regulation

States are using billing regulation to shape how certain hospital charges are structured and passed on to patients, particularly billing practices that increase consumer out-of-pocket costs without clinical justification. Several states, such as Maine, Connecticut, and Washington, have focused on limiting facility fee billing and advancing site-neutral payment policies to prevent higher charges when routine services are delivered in hospital-owned outpatient settings rather than independent offices.

Other states are pursuing broader price regulation strategies to contain overall hospital spending. Rhode Island caps annual hospital reimbursement growth and enforces affordability standards, which have contributed to a 9.1 percent reduction in prices and significant savings for commercially insured residents. Oregon established reference-based pricing for its state employee health plans, which caps reimbursement for in-network hospitals at 200 percent of Medicare, and out-of-network hospitals at 185 percent of the Medicare rate. This has generated an estimated $107.5 million in savings in its first two years. In 2025, Indiana and Vermont enacted reference-based price ceilings for certain hospitals, representing the first state efforts to apply this approach across the commercial market.

Competition & Ownership

States are also leveraging their authority to oversee market transactions and entity ownership to protect affordability. Research consistently links hospital consolidation to higher prices without any meaningful increase in quality, with some studies finding patient experiences worsened following hospital acquisition. By slowing or reshaping consolidation, policymakers aim to limit price growth, preserve competition, and keep costs down for consumers.

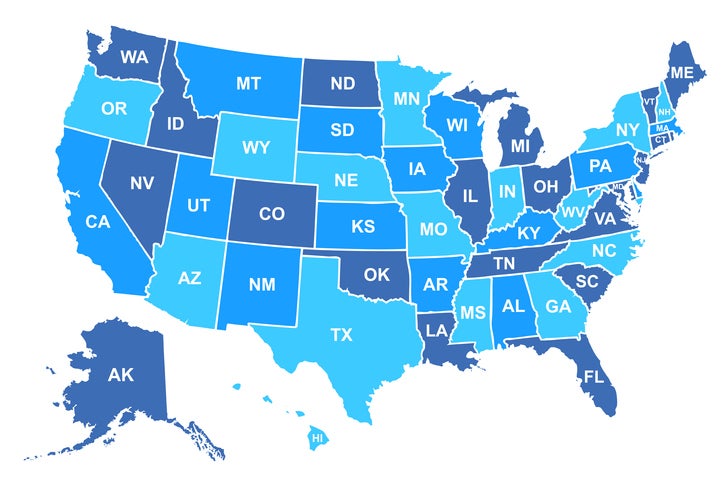

Across the country, at least 35 states require hospitals to submit detailed reports of mergers, acquisitions, or affiliations, and at least 15 states give regulators authority to approve, modify, or block transactions that could reduce competition or raise prices. In New Mexico for example, the legislature created a formal transaction review process, requiring hospitals to submit detailed ownership and financial information, allowing regulators to assess the potential effects on prices, market concentration, and patient access.

In Massachusetts, the decline and eventual collapse of the private equity–backed Steward Health Care system exposed gaps in oversight, substandard quality, and unchecked profiteering at the expense of patients and health system staff. In response, the legislature expanded transaction reporting to include private equity, real estate investment trusts, and management services, subjected more transactions to state review, and strengthened regulatory authority over ownership changes that could affect cost, access, or quality.

Transparency & Disclosure

Transparency initiatives provide a foundation for evidence-based policymaking and help stakeholders make informed decisions about health care spending. State policymakers are bolstering federal price transparency mandates by requiring hospitals and health plans to disclose detailed price and claims information, standardize reporting formats, and maintain compliance. Colorado for example has been a leader in strengthening transparency; the state has codified and enhanced both hospital and insurer price transparency requirements, and the Colorado Division of Insurance has the authority to issue penalties, fines, and other enforcement actions on insurers who are noncompliant.

States are also advancing ownership transparency and broader financial disclosures to illuminate who controls hospitals and provider networks. In 2025, multiple states including Massachusetts, Indiana, New Mexico, and Washington enacted or introduced laws requiring hospitals and other health care providers to disclose ownership structures, including private equity and complex corporate affiliations, helping regulators and consumers understand how ownership influences billing, market behavior, and costs. Colorado’s statutory hospital financial transparency reporting system requires audited financials and utilization data and produces annual state reports on hospital costs, revenues, profits, and uncompensated care that inform policy discussions and highlight affordability trends at both the state and individual hospital level. Similarly, Delaware enacted legislation in 2026 requiring hospitals to submit detailed financial and operational data to a state review board that evaluates compliance with cost benchmarks, issues written findings, and may impose significant penalties for reporting violations.

By combining price, ownership, and financial transparency, states can illuminate the drivers of health care costs, empower purchasers and regulators, and support policy actions that directly improve affordability for patients.

Conclusion

Policymakers can act now to make health care more affordable. States have a range of tools at their disposal – strengthening transparency, expanding merger oversight, enforcing antitrust protections, and implementing price caps – that can deliver meaningful improvements for patients and consumers. While no single measure is a silver bullet, these steps lay the groundwork for broader, systemic reforms that confront the full range of cost drivers, from pricing and billing practices to market consolidation and ownership structures.